Max 401k Contribution 2025. 401 (k) contribution limits are increasing from $22,500 to $23,000 in 2025, and from $30,000 to $30,500 for those age 50 or older. Washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,000, up.

The contribution limit will increase from $22,500 in 2023 to $23,000. This year, 401(k)s max out at $23,000 for savers under age 50 and $30,500 for those 50 and over.

401 (K) Pretax Limit Increases To $23,000.

In 2023, the 401 (k) contribution limit is $22,500 for employees, or $30,000 for employees age 50 or older.

The Ira Catch‑Up Contribution Limit For Individuals Aged 50.

The dollar limitations for retirement plans and certain other dollar limitations.

If You're An Average Earner,.

Images References :

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, For 2025, the contribution limit increases again to $23,000. Irs releases the qualified retirement plan limitations for 2025:

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, For 2025, those limits rise to $23,000, and. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up to $23,000 in 2025, a $500 increase.

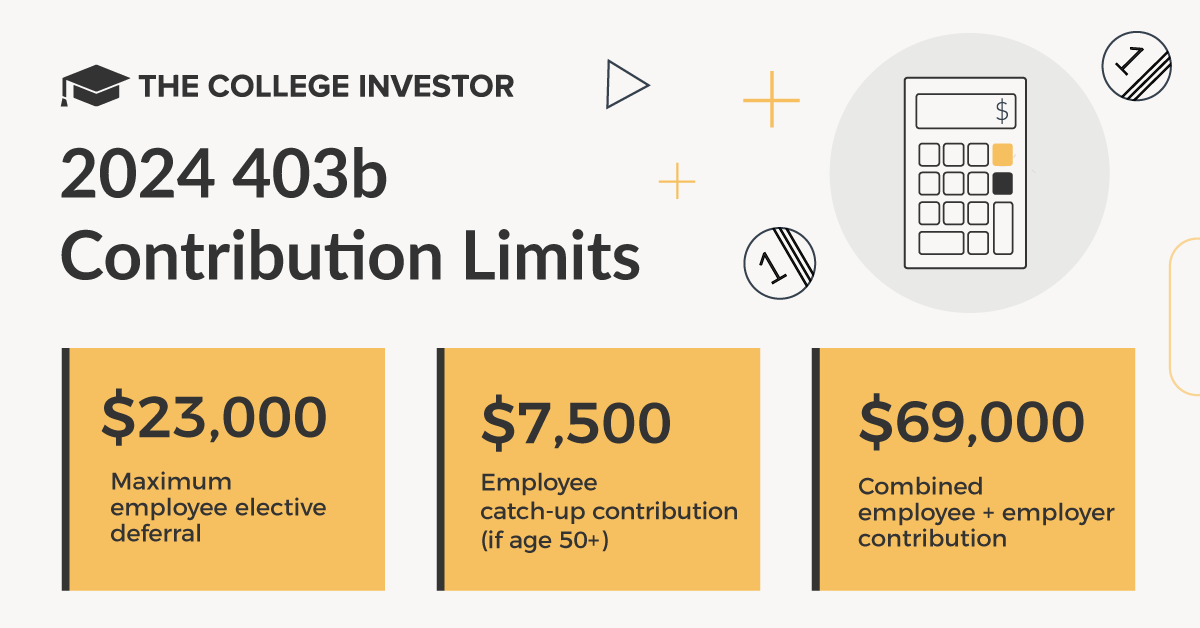

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

403(b) Contribution Limits For 2023 And 2025, The 2025 401 (k) and 403 (b) employee contribution limit will increase to $23,000 for those under 50. But one of the advantages of being 50 or older is that you can also make.

Source: www.blog.passive-income4u.com

Source: www.blog.passive-income4u.com

IRA Contribution Limits And Limits For 2023 And 2025, People under age 50 can generally contribute up to $23,000 per year to their 401 (k) plans, while those age 50 and. But when you see what a $12,000 contribution in 2025 might do for your future, you.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2025, This year, 401(k)s max out at $23,000 for savers under age 50 and $30,500 for those 50 and over. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

401k Maximum Contribution Limit Finally Increases For 2019, The 2025 elective contribution limit to 401 (k) plans is $23,000. In 2025, the contribution limit.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2025 Contribution Limit Chart, Irs releases the qualified retirement plan limitations for 2025: 401 (k) contribution limits in 2023 and 2025.

Source: streamgilit.weebly.com

Source: streamgilit.weebly.com

streamgilit Blog, If you're age 50 or. 401 (k) limit increases to $23,000 for 2025, ira limit rises to $7,000.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401k Contribution Limit Financial Samurai, In 2023, the 401 (k) contribution limit is $22,500 for employees, or $30,000 for employees age 50 or older. People under age 50 can generally contribute up to $23,000 per year to their 401 (k) plans, while those age 50 and.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

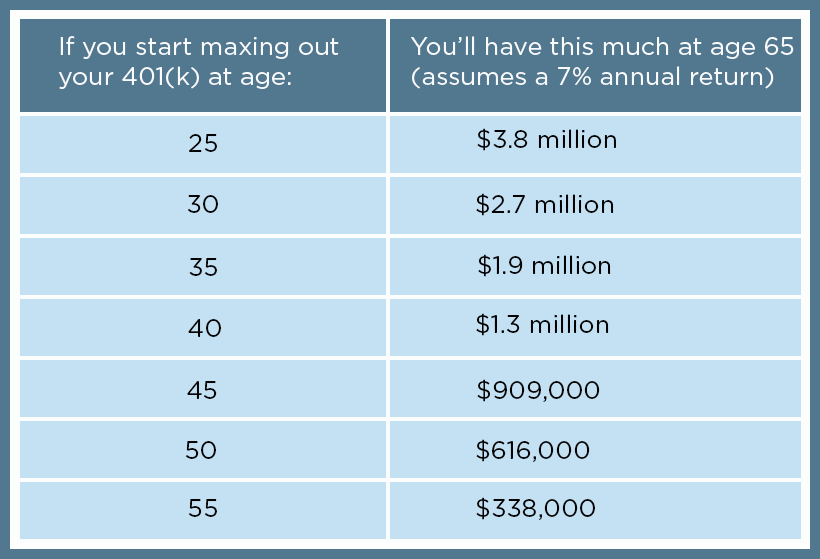

Here's When You'll A 401(k) Millionaire Financial Samurai, For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 401 (k) 2023 limit of $22,500. The 2025 elective contribution limit to 401 (k) plans is $23,000.

Retirement Contribution Limits Are Adjusted Each Year For Inflation, And The Limits For Iras And 401 (K)S Are Different.

If you're age 50 or.

In 2025, The Contribution Limit.

For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 401 (k) 2023 limit of $22,500.